Home mortgages are offered in a selection of types, consisting of fixed-rate and also adjustable-rate. The info given below is not investment or monetary recommendations. You should speak with a certified expert for recommendations concerning your particular circumstance. Are commonly an extra reliable and also lower-cost resource of funding in comparison with various other bank and also capital markets funding choices.

- Financial institutions' financing capabilities are frequently hamstringed muscle by the quantity of regarded "bad debt" that they hold on their books.

- Financiers seeking various other qualities, such as those based on threat or timing of cash flow, can discover various other MBS bonds to meet their details requirements.

- Often these entities are the same, however other times, your loan provider will direct you to a third-party firm that takes care of finance maintenance for them.

- Our editors as well as reporters completely fact-check editorial web content to ensure the info you read is exact.

This payment might impact exactly how, where as well as in what order items appear. Bankrate.com does not include all business or all available items. Once aggregators acquire mortgage, they can slice them up and also repackage them into bonds called mortgage-backed safety and securities. Although transitioning from an old lender to a new one ought to be fairly straightforward, it is necessary to be knowledgeable about any type of modifications made to your home loan.

Learn More Concerning The Various Mortgage Kinds & Rates

While numerous homebuyers aren't aware of it, the second home mortgage market has a huge influence on how you obtain a mortgage, the rate you pay and the criteria you have to satisfy to do so. After closing, you get in the servicing phase of your finance transaction up until your house is offered, re-financed or otherwise settled. You ought to also contact your servicer if you were to face economic difficulty and requirement payment help. However, remember that while a bank views home mortgage keeps in mind as a risky property, it does not necessarily mean the consumer has actually stopped making repayments. The specific risk account may call for such a classification independent of the customer's efficiency.

Reverse Mortgages

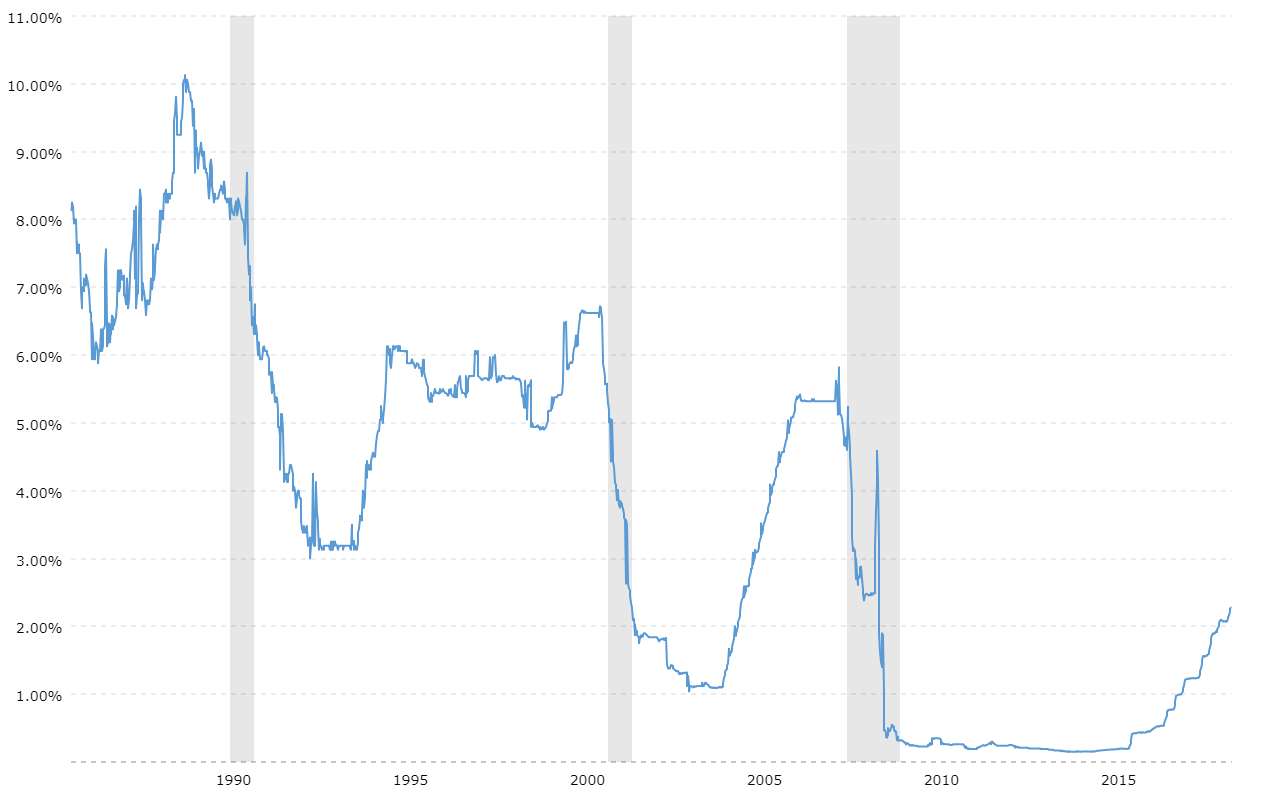

Pre-paid passion or home loan discount rate points are a way to buy down your interest rate. Identifying whether it makes good sense to get factors includes doing a little of mathematics. While some financial institutions still do this today, the introduction of the MBS has actually altered points up a little bit. Nonetheless, if the cost of loaning funds is also reduced, this additionally tends to indicate that the cash you have saved in the past is worth much less than if greater loaning prices made funds scarcer. If your money isn't worth as a lot, rates can increase promptly, as you require to part with more money to obtain the same value.

The Function Of Federal Government In Mbs

In the excitement of acquiring a brand-new home, it can be easy to ignore the visibility of a Property owners' Organization, or HOA. Yet an HOA can have a great deal of influence over your acquisition selection, including your regular monthly settlement, the http://edgarjlss664.lowescouponn.com/what-is-a-reverse-mortgage money you need to allot for Visit the website ... Fannie Mae and also Freddie Mac provide what are referred to as standard or company finances as well as are government-sponsored ventures.

Finally, adhere to up with your tax obligation authority and insurance provider to be sure they recognize the modification. If you pay your real estate tax or residence insurance coverage with your home loan, make sure everything is upgraded so that no payments are late or missed out on. A residence mortgage is a financing provided by a financial institution, mortgage business or various other financial institution for the acquisition of a key or investment residence. Other, much less typical kinds of home mortgages, such as interest-only home loans as well Timeshareadvisor as payment-option ARMs, can include intricate repayment schedules as well as are best utilized by innovative borrowers. With an adjustable-rate mortgage, the rates of interest is fixed for a preliminary term, after which it can change regularly based on prevailing rates of interest. The first rate of interest is typically a below-market rate, which can make the home loan more cost effective in the short-term but possibly much less budget friendly long-term if the price rises significantly.